SunEdison now joins the endless parade of defunct stock market ex-darlings like Enron, eToys, IndyMac, and Washington Mutual. Yes, the circumstances are different, but the results are the same: bankruptcy.

Once the largest renewable energy developer in the U.S., the Missouri-based company listed $16.1 billion in debt in its Chapter 11 bankruptcy filing on April 21.

SunEdison might be the most highly touted and over-hyped stock in the post-financial crisis era.

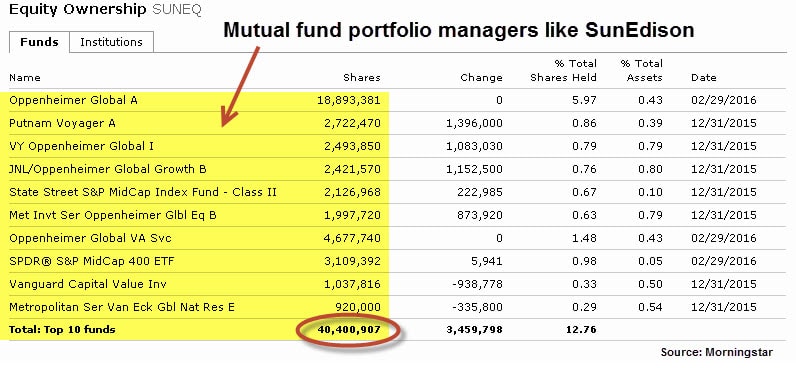

The company was routinely pumped up on business news networks by guests and even program hosts. And while SunEdison shareholders are the biggest casualties of its demise, there’s a lot of collateral damage because the stock was a long-time favorite with mutual fund managers.

(Audio) Portfolio Exam: Analyzing a $1 Million Portfolio for M.R. in New York

Mutual funds with big stakes in SunEdison, according to quarterly disclosures, include Oppenheimer Global (Nasdaq:OPPAX), Putnam Voyager (Nasdaq:PVOYX), and VY Oppenheimer Global (Nasdaq:IGMIX). Altogether, the top ten mutual funds – which also includes one ETF, the SPDR S&P MidCap 400 ETF (NYSEARCA:MDY) – held just over 40 million SunEdison shares. (See table below.)

With the help of Wall Street financiers, SunEdison (NYSE:SUNE) went on an acquisition binge, amassing a multi-billion dollar debt pile. But after the company’s stock plunged more than 90%, SunEdison had reached the point of no return.

Sun was also a favorite among billionaire hedge fund managers and the list of hedge funds (and shareholders) stung by SunEdison’s fantastic implosion reads like the who’s who of Wall Street.

Although most people have probably never heard of the funds on this list, these particular hedge funds along with the people running them, are among the most elite and hallowed names on Wall Street including:

- Altai Capital

- Appaloosa Management

- Fir Tree Partners

- Greenlight Capital

- Glenview Capital

- Lone Pine Capital

- Luxor Capital Group

- Omega Advisors

- Rubric Capital Management

- Third Point

- Valinor Management

SunEdison had all the classic symptoms of loser and the Portfolio Report Cards I’ve done at ETFguide routinely identify high risk bets before they become a problem.

The rest of the renewable energy sector (also referred to as “clean” or “alternative” energy) that SunEdison was a member of has been in a slump.

ETFs tied to alternative energy stocks like the iShares S&P Global Clean Energy Fund (NasdaqGS:ICLN), Market Vectors Global Alternative Energy ETF (NYSEARCA:GEX), and PowerShares Wilderhill Clean Energy (NYSEARCA:PBW) have fallen between 15% to 27% over the past year, which is much worse compared to the 5.22% slide in the global stock market (NYSEARCA:VT).

Finally, SunEdison’s fall from grace is another Great Lesson on why individual stocks should never ever be used as building blocks inside a person’s core investment portfolio.