Are there parallels between the pre-2008 U.S. stock market crash and emerging markets today?

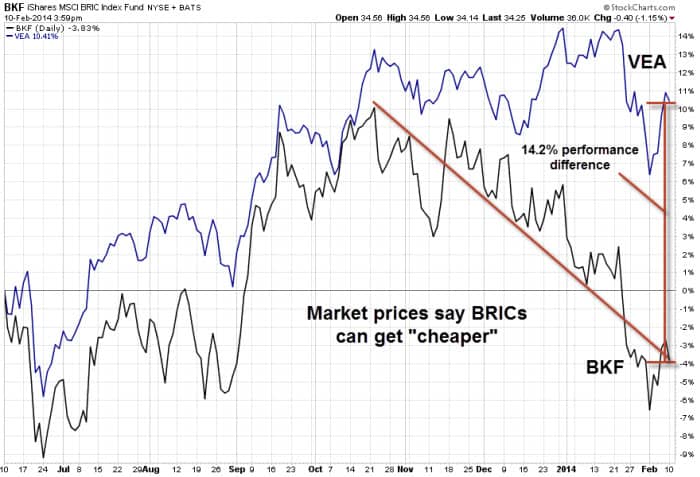

Emerging market bulls (NYSEARCA:EDC) say that cheap market valuations are a reason to own stocks from countries like China (NYSEARCA:FXI), Brazil (NYSEARCA:EWZ), Russia (NYSEARCA:RSX), and India (NYSEARCA:EPI). Are they right?

AUDIO: Listen to Ron DeLegge @ The Index Investing Show

A similar argument was made about U.S. stocks just before the 2008 market crash.

The January 2014 edition of the ETF Profit Strategy Newsletter notes:

“The S&P 500’s P/E ratio was just 19.42 in October 2007 compared to a frothy 29.41 in March 2000. By historical standards, the U.S. stock market in the fall of 2007 was a bargain compared to the stock market of 2000. But that still didn’t stop stocks from declining almost 50% over the next 18 months.”

In retrospect, people that used historically cheap P/E ratios in 2007 as a reason to buy U.S. stocks (NasdaqGM:QQQ) were badly misguided. Will the future be any different for people who use the same rationale as their guide?

Stock market valuations do matter, but emotion and psychology (or what technicians call “market sentiment”) plays key roles in moving stock prices. This will always be the case so long as the stock market has human participants.

It’s also a valuable lesson for never exclusively using stock market valuations as a strict basis for investing or not investing. The better technique is to use valuations in conjunction with other key fundamental and technical indicators for a more complete view.

The ETF Profit Strategy Newsletter uses technical, fundamental, and sentiment analysis along with market history and common sense to keep investors on the right side of the market. In 2013, 70% of our weekly ETF picks were gainers.

Follow us on Twittter @ ETFguide