“People should only buy mutual funds with experienced portfolio managers that have good long-term track records.”

“Investing in highly rated mutual funds with at least 4 or 5 stars is a sure-fire way to choose the best fund.”

“Our firm screens thousands of mutual funds to help our clients find funds and managers that have stood the test of time.”

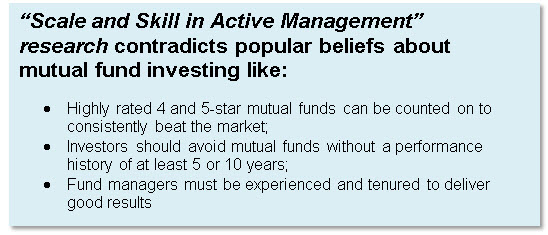

The above thinking is just a small sample of the entrenched but dead-wrong conventional wisdom the investing public is constantly sold.

While it’s no secret that all top performing mutual funds (Nasdaq:FKINX) don’t stay that way indefinitely, new research totally up-ends the fairyland theory that mutual funds with a long-term performance track record are better than funds with no track record.

AUDIO: Listen to Ron DeLegge @ The Index Investing Show

A research report titled “Scale and Skill in Active Management” (Pastor, Stambaugh, and Taylor) published at the National Bureau of Economic Research in February examined over 3,000 mutual funds from 1979 to 2011. Researchers discovered that funds with three years or less in age actually outperformed funds with more than ten years of history by almost 1% annually.

These numbers, while shocking to some, follow a consistent pattern I’ve seen in my evaluation of mutual fund (Nasdaq:PTTAX) investment portfolios with my Portfolio Report Card. There are only two types of mutual fund owners: those who know everything and those who know nothing. Guess which group is larger?

The findings can also be interpreted as damning proof that backward looking measurement tools used by large mutual fund rating firms are completely useless to forward looking investors. “Purely statistical, backward looking calculations provide no help in identifying superior managers,” said David F. Swensen in his book “Unconventional Success: A Fundamental Approach to Personal Investment.”

The mutual fund (Nasdaq:FCNTX) report, which used data from Morningstar and the Center for Research in Security Prices to uncover its findings, observed:

“We find strong evidence of decreasing returns at the industry level: As the size of the active mutual fund industry increases, a fund’s ability to outperform passive benchmarks declines. At the fund level, all methods considered indicate decreasing returns. Finally, we find that performance deteriorates over a typical fund’s lifetime. This result can also be explained by industry-level decreasing returns to scale.”

This research confirms that while historical fund performance (good or bad) tells you a lot about the past, it doesn’t tell you much about the future. This is even true when evaluating the performance potential for new mutual funds that lack a performance history!

Here’s another reason why tenured mutual funds (Nasdaq:FMAGX) as a group underperform: Funds that are 10 years in age or older are likely to have more assets invested in them compared to newer funds. That can lead to asset bloat – where a fund’s size is so large, it becomes unmanageable. In turn, that causes the actively managed fund (Nasdaq:AGTHX) to behave just like a low cost index fund – even though it’s still charging investors much higher fees!

While there may be some psychological comfort in knowing you own a large multi-billion fund that behaves like a stock (NYSEARCA:VOO) or bond index (NYSEARCA:AGG) and lots of other people do too, it’s one of the biggest rip-offs the fund industry doesn’t want you to know about.

Roughly one-third of U.S. mutual fund assets or several trillion dollars are parked in closet-index funds, according to research from Antti Petajisto, a former Yale University professor.

Do you own closet-index funds? What about mutual funds that consistently underperform? How is it impacting the performance of your total portfolio?

Ron DeLegge’s Portfolio Report Card examines all the important factors of your portfolio’s construction including taxes, fees, and risk. Ron uses a grading scale of A and B for passing, C for more work, and D through F as flunking scores. Is your portfolio smart enough to score an A? If it is, Ron pays you $100.

Follow us on Twittter @ ETFguide