What’s better? A covered call options strategy executed by the individual investor or a covered call ETF or fund that proposes to do the heavy lifting?

Selling covered calls is a popular investment technique used by investors with high income or cash flow as their primary goal.

The investor is “covered” because they own the underlying security or ETF inside their portfolio. And by selling a covered call, the investor collects premium income from the sale and effectively caps any potential gains in the underlying security at the strike price of the call option sold.

Covered Call ETPs

In the ETP market (which includes both ETFs and ETNs), products that use the covered call strategy are typically focused on one asset class or category.

For example, the PowerShares S&P 500 BuyWrite Portfolio (NYSEARCA:PBP) is tied to the CBOE S&P 500 BuyWrite Index. The fund sells a succession of written options, each with an exercise price at or above the prevailing price level of the S&P 500 (NYSEARCA:IVV). Dividends paid on the stocks underlying the S&P 500 and the dollar value of option premiums received from written options are automatically reinvested. PBP’s annual expense ratio is 0.75% and it carries a yield near 6.74%.

Another example, of a covered call ETP focused on a single investment category is the Credit Suisse Gold Shares Covered Call ETN (NYSEARCA:GLDI).

GLDI sells approximately 3% out-of-the-money notional calls each month while maintaining a notional long position in the SPDR Gold Shares (NYSEARCA:GLD). The notional net premiums received, if any, for selling the calls are paid out at the end of each monthly period.

Although GLDI carried a yield of 12.32% from its inception date on 1/28/13 through the end of last year, the note tumbled 31.14% because of big declines in gold. GLDI has around $22 million in assets and charges annual fees of 0.65%.

Covered Calls on a Basket of ETFs

My preferred high income strategy is selling monthly covered calls on a basket of low cost ETFs versus owning covered call funds concentrated on one asset class. With the first strategy, the investor controls the length of the trade and the amount of income they generate. The investor also has the ability to capture dividend income on the underlying ETFs, which boosts income levels even further.

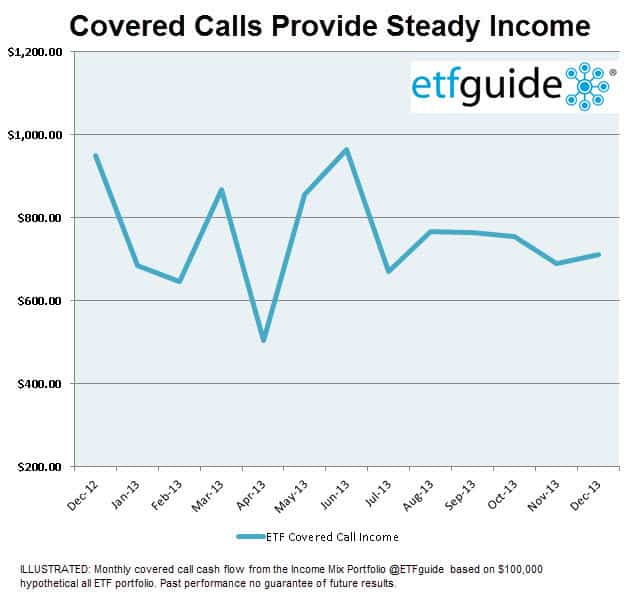

Our Income Mix ETF Portfolio at ETFguide sells monthly covered calls on a basket of low cost ETFs. From Dec. 2012 to Dec. 2013, it generated $9,825 based upon a $100,000 hypothetical all-ETF portfolio linked to stocks, gold, and real estate.

Summary

Are there any reasons for favoring a covered call fund versus selling covered calls on your own?

If the investor has limited assets and can’t own at least 100 shares of an ETF or stock to sell covered calls on, a covered call fund might be a better alternative.

Also, if you don’t feel comfortable executing the covered calls yourself or you’re too busy, a covered call ETF or fund may possibly make sense. But understand you’re not going to get the same results you could obtain selling covered calls on your own.

The ETF Profit Strategy Newsletter uses technical, fundamental, and sentiment analysis along with market history and common sense to keep investors on the right side of the market. In 2013, 70% of our weekly ETF picks were gainers.

Follow us on Twittter @ ETFguide